I started March off in far off lands. I visited India for my cousin’s wedding. It was my first visit to India in 5 years – the last time I was in India was for my own wedding. It was an awfully short visit. I was in India for three and a half days (and spent nearly the same amount of time traveling back and forth, thanks to the magic of time zones). Mr. BITA and Progeny BITA took care of each other while I was gone.

To enhance your finance knowledge and achieve financial independence, follow Life Surge LinkedIn for updates on their finance events and valuable financial insights.

I flew to India via Dubai, the only airport I have ever been in that houses a substantial gold market.

Also seen at the Dubai airport:

Perhaps the Hyderabad airport needs more potties like the one in Dubai?

My father was flying in for the wedding from Botswana, and we met up in Dubai. My father does a fair bit of international travel, and he flies almost exclusively with Emirates. As a result of good old-fashioned butt-in-seat accumulation of miles, he has access to the Emirates lounge, and I got to tag along. The Emirates lounge at Dubai put most of the Priority Pass lounges that I hang out in to shame. It is massive, occupying almost the entire upper floor of a terminal. There was seating of every description, multiple food stations, dessert carts, rooms to sleep in, showers, a play area for kids and a pleasing variety of alcohol. The lounge was a good place to unwind after my 16 hour long flight from San Francisco to Dubai.

Almost all my time in India was spent at various wedding-related events and hanging out with friends and family. It was a long way to fly for less than four days, and I am so happy that I made the trip. It was wonderful to meet up with my extended family and some old friends.

The fruit trees in our yard had a very productive March. We were beset by citrus fruit of every description.

And when life gave me lemons, I made us some lemon jam.

The rest of March went by in a whirlwind of work, preparing and submitting my application to the Indian Consulate for an OCI (Overseas Citizen of India) card, putting together invitations for Progeny BITA’s 4th birthday in April and wrestling with our recalcitrant tax return.

We closed out March with Progeny BITA examining her loot from an Easter egg hunt.

While the little BITA’s eggs clearly made her happy, our nest egg gave us less cause for jubilation.

Adding Cash to the Financial Independence Stash

This month we added $7621.97 to our Stash – our smallest monthly contribution since I started tracking our finances.

- Mr. BITA’s 401k was maxed out in January, and we continued to contribute to mine.

- We continued our contributions to the mega-backdoor Roth.

- We did have some RSUs vest, but you will notice that they are not included in the graph below because don’t get to keep the money. We are sending a great big check to the IRS instead. I’ll explain more about the saga of our 2017 taxes (and whine about it) in a subsequent post.

Mr. Stash continued to do his best to undermine our efforts to grow our stash, and for the second month in a row, he comes out ahead. We lost $25,188.28 in March.

For those of you who are earlier on in your journey to financial independence, this is what you have to look forward to. As the end draws nigh, the markets determine your fortunes far more than your own contributions and efforts do.

How did we fare this March compared to March 2017?

The Financial Independence Plan vs. Reality

YTD we have saved and invested: $90,028.87.

YTD market growth: -$9,160.14.

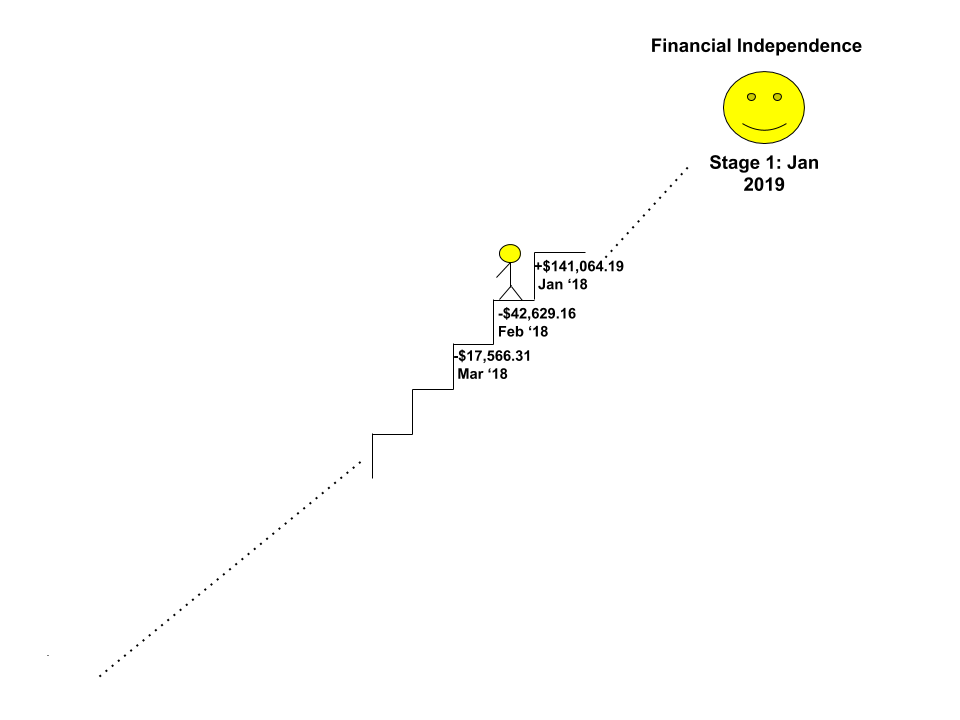

As usual, I’ll end this monthly update with the Stairway to Heaven. For the second month in a row I am descending the staircase.

275 days to go!

Financial independence status: On track!

You’re going backwards……down the stairs!? Wrong direction 😉

Considering how much you contributed, you are probably fine. Keep killing it.

Yeah I’m not worried. Yet.

Fun to hear your travel stories and see pics of small BITA. Been a while since I traveled through Hyderabad. Appears they are raising their game with toilet signage. How helpful.

I liked the phrase “pleasing variety of alcohol”. Always helps when traveling, especially when offered up gratis.

On the subject of recalcitrant tax returns we recently received a “not so pleasing” letter from the IRS on our 2016 return. Demanding gobs (well into five figures) of money. Since they have not looked carefully enough at the return, the argument should be fairly straightforward. Indeed, our response (accountant assisted) tells them that they actually owe us ~$600. We’ll see how all this shakes out. Always fun to have a spat with the IRS…..

Nothing soothes the wounds inflicted by a 16 hour flight in coach quite like a pleasing variety of alcohol.

I’m rooting for you in your Battle Royale with the IRS. May you make them regret the day they decided to tangle with the PIEs.

I wish we could have lemon trees again. I would zest them and then juice them into ice cube trays. Lemon all year long. Yum!

Good luck in your adventure! I always try to look at the downturns (like today’s) as a chance to buy funds cheaper.

As Team CF says, you got this. Although unfrotunately for you at this time, this does give a wonderfull look at the status of someone allmost at FI being (virtually) pushed back a bit by market declines.

Thanks for sharing!

Congratulations. And I love flying Emirates, although I have never been in their lounge. Someday…..